When GST Registration is Required in India?

- 14 Apr 25

- 7 mins

When GST Registration is Required in India?

Key Takeaways

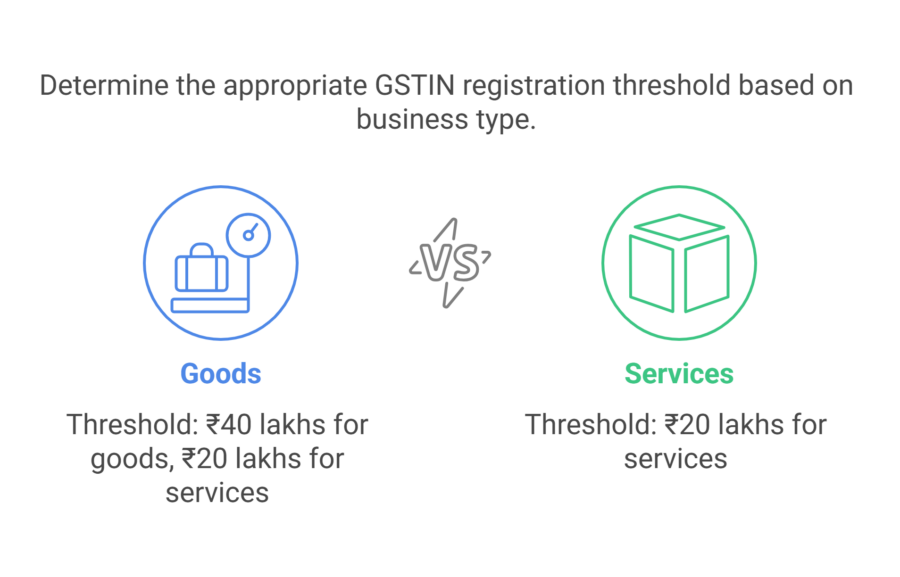

- GST registration is mandatory if turnover exceeds ₹40 lakhs (goods) or ₹20 lakhs (services).

- Certain businesses must register under GST regardless of turnover.

- Accurate documentation (PAN, Aadhaar, address proof) is essential.

- GST registration must be completed within 30 days of eligibility.

- Voluntary registration allows businesses to claim input tax credits.

The Goods and Services Tax (GST) is a comprehensive indirect tax system implemented in India on July 1, 2017. It has replaced multiple central and state-level taxes, such as excise duty, service tax, VAT, and others, bringing uniformity in taxation across the country.

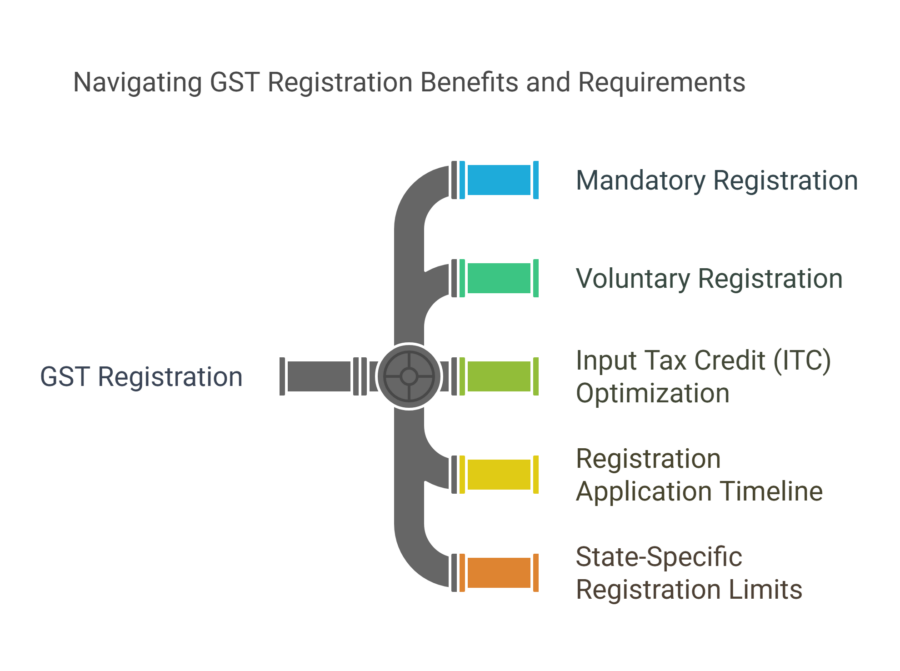

Under GST law, every business involved in the supply of goods or services must evaluate whether they need to register under GST. While registration is mandatory for certain businesses based on turnover and nature of supply, others may voluntarily opt for it to avail benefits like input tax credit. Non-compliance with GST registration rules can lead to penalties and legal consequences.

So, read this article to learn when GST registration is required in India in detail here.

Criteria For Applying For GSTIN

The registration criteria (eligibility criteria for GST registration) to get GSTIN (Goods and Services Tax Identification Number) includes the annual aggregate turnover of the concerned business. Suppose the yearly aggregate turnover (registration threshold limit) of a company is more than ₹40 lakhs (other than specified Northeast and hill states) or ₹20 lakhs for service providers.

In that case, it is mandatory to register under GST. It takes up to 30 days to make it a liable registration.

Businesses for Whom GST Registration Is Mandatory Irrespective of Annual Turnover

Here are the businesses that mandatorily need to register under GST:

● Individuals involved in inter-state taxable supplies (normal registration)

● Casual taxable person

● Taxable individuals under the reverse charge mechanism

● Individuals paying tax under Section 9(5)

● Non-resident taxable persons or persons providing online information and database access to Indians from abroad

● Tax deductors under Section 51, even if they are separately registered as tax deductor

● Individuals making taxable supplies on behalf of other taxable individuals

● Input Service Distributor

● Persons supplying goods or services using e-commerce platforms

● Electronic commerce operators (e-commerce operators)

● Individuals supplying online information from abroad to persons in India, excluding registered persons

● Any specific class of persons as specified by the Government on the GST Council’s recommendation

Necessary Documents For GST Registration

Here are the important GST registration documents that businesses need:

For Sole Proprietor

A sole proprietorship firm will complete the eligibility for GST registration by providing the following documents:

● PAN card

● Owner’s Aadhaar card

● Address proof

● Owner’s photograph

● Bank account details

For Partnership Firm/LLP

A partnership firm or LLP needs to following documents:

● Partners’ PAN card

● LLP agreement/ partnership deed

● List of partners

● Partners' address proof (driving license, passport, voter identity card, Aadhaar card)

● Firm’s address proof

● Photographs of authorised signatories/ partners

● Authorised signatory’s Aadhaar card

● Proof of appointment of authorised signatory

● Registration certificate or board resolution of LLP (proof of business registration)

● Bank account details

For Private Limited Companies

Here are the documents that private limited companies need for GST registration:

● PAN card of the company

● Certificate of Incorporation ensuring company registration

● Memorandum and Articles of Association

● PAN card and address proof of directors

● Board resolution with an authorised signatory appointment

● Company address proof for the place where registration is needed

● Bank account details

● Proof of address of principal place of business entity

● Directors’ and authorised signatory’s photographs

● Authorised signatory’s Aadhaar card and PAN card

Notably, entities should provide accurate business details followed by a valid email address and mobile number.

Things to Remember While Applying for GST Registration

Here are the things to consider while applying for GST registration:

- If a business must register under GST, ensure you apply for the GST registration certificate. This can help you claim an input tax credit (ITC) on inward supplies to reduce tax liability and collect GST on behalf of the government.

- Registration is essential to collect GST and claim ITC as per GST laws. Thus, one of the benefits of GST registration is the ability to reason and optimise ITC.

- If you are an eligible entity, you must file a GST registration application within 30 days from the liable registration date.

- In case you are a business not mandated to register under GST, you can apply for a voluntary registration process.

- The limit for states like Puducherry, Mizoram, Meghalaya, Tripura, Manipur, Sikkim, Arunachal Pradesh, Nagaland, and Uttarakhand varies from normal rates.

Conclusion

GST registration is mandatory for businesses exceeding the turnover limit and those engaged in specific taxable activities. While exemptions exist, voluntary registration can be beneficial for growing businesses. To answer when GST registration is required in India, you need to know the threshold limits of annual turnover and the place of business.

For instance, the threshold limit for special category states differs from other states. Further, you need to know the type of GST registration you need based on the type of business. Ensure you register yourself under GST within the stipulated time to avoid late fees, penalties, and interest imposition.